Beyond insurance, Part I: Facing up to climate risks in Asia

As the world warms and extreme weather events become more frequent and severe, insurance is reaching its limits as a safety net for businesses.

A six-part series by FM on examining the need to invest in climate change adaptation measures as more extreme weather events test the limits of insurance.

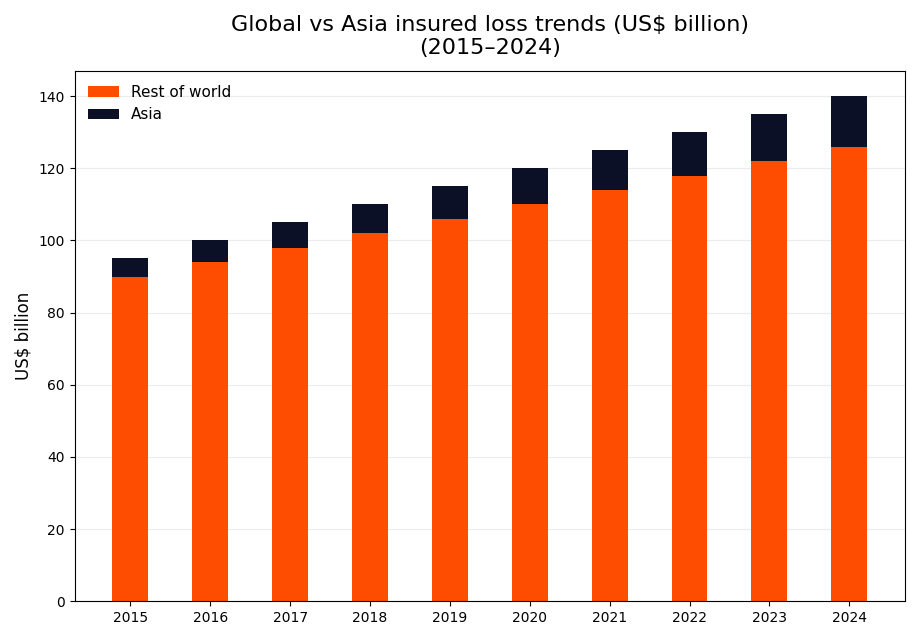

In Asia, a resilience paradox persists; while economic losses from natural disasters reached US$74 billion in 2024, only US$4 billion – or 5.4% - were insured, underscoring a vast protection gap that leaves most recovery costs uncovered.

In Thailand, flood and crop insurance premiums have increased in response to repeated extreme weather events, while coverage limits have tightened. In Indonesia, Malaysia, and Singapore, the cost of insuring factories and supply chains against typhoons, floods, and other climate-related risks has surged, with some insurers opting to shorten coverage periods or exclude specific perils altogether.

A decade ago, the United Nations Framework Convention on Climate Change (UNFCCC) outlined the imperative to limit global warming to 1.5°C. But today, data shows that global temperature over the next five years could hit up to 1.9°C warmer leading us to be on track for 2.7°C of warming by 2100.

“If global emissions aren’t cut more aggressively,” says Dr. Julien Oliver, Research Group Manager for Climate Risk & Resilience at FM, “we’ll face escalating weather-related losses—both in terms of insured damages and the growing human cost in vulnerable communities. The financial exposure is rising, and so is the urgency to act.”

Once a reliable backstop for businesses facing natural disasters, insurance is becoming less accessible, more expensive, and in some cases, unavailable - especially for those operating in high-risk zones. Dr. Oliver, who has been closely studying climate change from his base in Singapore, adds, “Insurance can soften the blow, but on its own, it’s no longer enough to protect businesses from the escalating costs and consequences of a warming planet. A broader approach to risk is now essential.”

The insurability tipping point

Insurance companies and reinsurers (the companies that insure the insurers) are sending clear signals to businesses and governments that the status quo is not sustainable.

The frequency and severity of climate-driven disasters in Asia - floods, wildfires, typhoons - are increasing, leading to record-breaking insured losses year after year. Traditional insurance models, built on historical risk data, are struggling to price risk in a world where yesterday’s weather patterns no longer predict tomorrow’s catastrophes. Insurers are also finding it more difficult to keep pace with the accelerating frequency and severity of climate-driven events.

The view from the US is a consistent one. “Insurance companies are more hesitant to offer large [policies], rates are going up, overall it’s getting tougher and tougher for companies to protect their risk via an insurance policy,” says Louis Gritzo, vice president and manager of research at FM.

While insurance is still vital to a healthy economy, giving business owners the confidence to invest, more insurers are now adopting ‘risk-based pricing’ or withdraw cover entirely due to climate change impacts.

As a result, insurance is becoming a last line of defence, not a guarantee of recovery. As Gritzo bluntly says, “Insurance can’t save you”.

Asian businesses must now take an active role in managing climate risk, leveraging advanced tools and investing in adaptation measures to protect their assets and operations beyond reliance on insurance.

In Southeast Asia and Hong Kong, where urban density and climate-related risks like flooding and extreme heat are intensifying, proactive adaptation is essential. Investing in resilient buildings, infrastructure, and operations—such as flood-proofing facilities, upgrading fire safety systems, or relocating critical assets—is already helping companies reduce losses and maintain operational stability. Early action aligns with regional government initiatives and demonstrates long-term business foresight.

“Insurance can’t save you.”

Retrofitting facilities and infrastructure to be resilient to floods, storms, and wildfires is also an approach that businesses can undertake. However, such projects are generally time and capital intensive, which will require careful planning and close cooperation between industry, local authorities, and governments over the coming decades.

A new era of risk management

The era of “insure and forget”, a traditional approach in the insurance industry where customers would purchase a policy and then largely disengage from it, is over. This model worked in a time of relatively stable risks and predictable environments - but as climate risks outpace the capacity of insurance markets, businesses must take an active role in managing climate risk, one that prioritises adaptation, resilience and long-term planning over short-term savings.

Leveraging advanced tools like FM’s comprehensive suite of climate resilience products like the FM Climate Resilience Tracker, FM Natural Hazard Map, our must-read 2025 FM Natural Disasters Report, and investing in adaptation measures to protect assets and operations, this shift to proactive mitigation is not just prudent, but also essential for survival in a world where the next disaster may be unprecedented.

FM’s approach to risk mitigation - combining engineering expertise, innovative risk assessment, and financial incentives - empowers clients to move beyond traditional insurance and build true climate resilience in their operations.

In part two, we’ll explore how businesses can make adaptation a core strategy, and how private investment and innovative partnerships are helping to fund this critical transition.