Businesses understand that extreme weather poses an ever-increasing threat to their operations, supply chains, and communities

The real challenge appears to be understanding the evolving nature of the threat, where and when it might strike, and how to mitigate it as effectively and efficiently as possible.

One difficulty is quantifying the full extent of extreme weather’s disruptive potential, explains Zach Armitstead, senior property broker at global risk management services provider Aon.

“Imagine the natural gas line goes out on a facility, and it doesn’t come back on for two weeks. There isn’t really any damage at the facility, but the business loses use of it, so how do they quantify that? I think that’s what a lot of people are still trying to figure out.

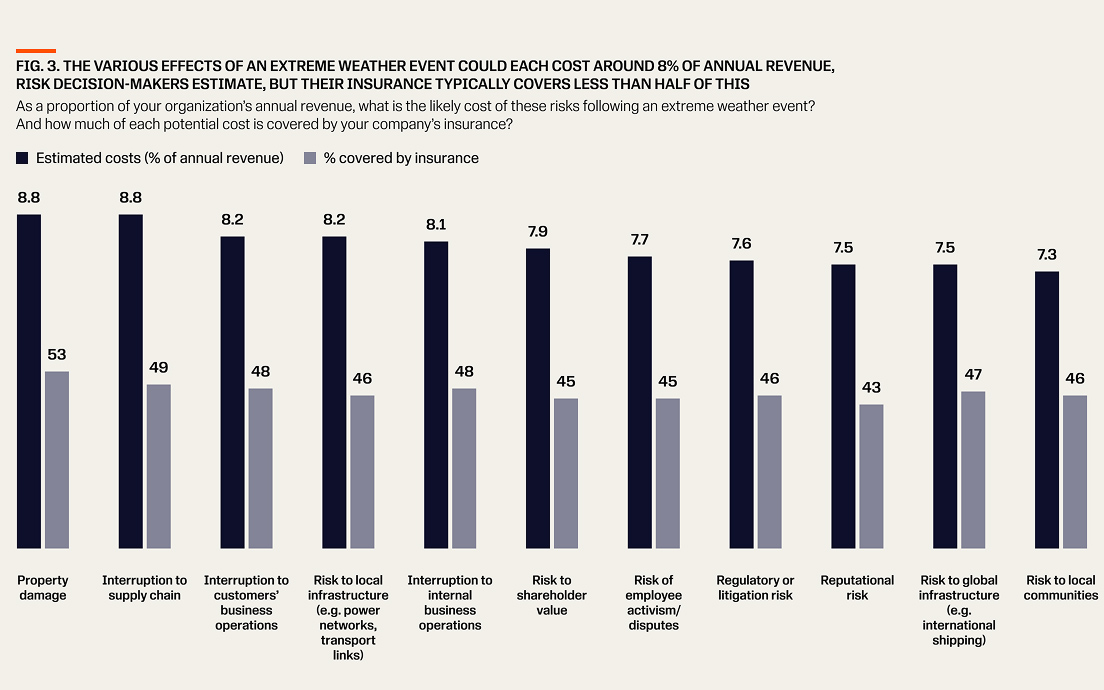

Still, risk decision-makers understand that the indirect effects of extreme weather can be just as costly as any immediate damage to their property and internal operations. They estimate that supply chain interruption, damage to local infrastructure, and disruption to their customers’ operations could each cost more than 8% of their annual revenue.

Brokers, meanwhile, believe that regulatory risk and the risks to global infrastructure and to local communities are the costliest potential outcomes of a poorly managed weather event.

Insurance is, of course, a vital tool in mitigating the potential financial impact of extreme weather events. But our survey respondents report that their current insurance policy covers less than half of the potential cost of extreme weather’s various effects, aside from property damage (see Fig. 3).

Brokers are more pessimistic. They estimate that, on average, their clients’ insurance would cover around 40% of the losses experienced due to an extreme weather event.

Cost constraints on insurance coverage

The primary reason for this shortfall in coverage is the cost of insurance, buyers and their brokers report. The largest share of both buyers (44%) and brokers (49%) identify this as the key reason why full coverage hasn’t been secured.

This cost focus reflects two trends. Firstly, the high frequency of catastrophic weather events in recent years has forced insurers to increase their rates. Meanwhile, rising inflation has put businesses under pressure to focus on short-term cost reduction.

“The cost of everything is increasing and the pricing elasticity for projects and products is constrained,” says Erica Wagner, SVP and head of global real estate at global food and drink giant, PepsiCo. “The question is: ‘Is there any way we can reduce the cost of insurance without exposing the business to greater risk?’”

Or as Adriano Lanzilotto, VP, client and partner learning at FM, puts it: “When insurance rates are going up, risk managers face the question: ‘Why are we spending so much on insurance?’”

Risk decision-makers know that this cost constraint on achieving full insurance coverage is undermining their resilience to extreme weather. One third rank the cost and limited availability of insurance among their top three challenges in mitigating the risks of extreme weather events.

Businesses’ cost focus may also explain why many powerful measures to mitigate extreme weather risk are underadopted, as we’ll see in our next chapter. Ultimately, though, this short-term view is leaving businesses exposed.

A better way is possible. By investing in the resilience of their property and operations to extreme weather, companies can both reduce the potential disruption of an extreme weather event and keep their insurance expenditure under control.

“We definitely prefer to invest in the resilience of our infrastructure instead of paying a [greater] premium to an insurance company,” explains Fabio Giovannini, head of enterprise risk management and insurance at Italian telco TIM.

Barisic, the biotechnology finance executive, says that investing in resilience has allowed the company to keep its insurance spending under control despite an increase in risk. “In a few cases, we have the same policy that we did 20 years ago,” he says. “The amount we pay is basically the same, adjusted for inflation, while some of our competitors pay five times that amount.”

This approach, of optimizing insurance spending by investing in resilience, requires a collaborative relationship with insurers. But, according to one interviewee for this report, some buyers view their insurers as risk “police” and try to keep interaction to a minimum.

“It’s difficult for some clients to move from viewing insurance as occupying a risk oversight role to one of mutual loss prevention,” says Dr. Gritzo. “That is our challenge as an industry—to partner with clients and move from transactional oversight to working together to mitigate the risks.”

FM’s mutual model is conducive to a more collaborative relationship, he adds. “Our mutual clients are part-owners of the company. When they do well, we do well, which allows us to work together towards the same goal. We issued nearly US$1.5bn in membership and resilience credits to our clients in 2024 to improve their resilience. It’s a different mindset than that found in more traditional insurance models.”

While cost will always be a consideration, investing in resilience need not add to the financial burden. Companies that prioritize long-term resilience over short-term cost reduction will be in a better position to withstand the impact of weather hazards and the cost of managing them. And there are ample opportunities for them to bolster that resilience.