Closing the extreme weather resilience gap

Weather patterns are changing rapidly and bringing ever greater levels of devastation to communities across the globe. According to the UN, the number of weather, climate or water-related disasters has increased by a factor of five over the last 50 years. Over that time, these disasters have caused over US$200M of economic losses on a daily basis.

The effects of these trends are increasingly evident. Extreme weather has become a regular fixture in news reports, with events ranging from catastrophic flooding in Texas, Colombia and Pakistan, to wildfires in California and Japan, as well as the UK’s most powerful windstorm in a decade.

And businesses are feeling the effect. According to our survey, 62% of companies in the industrial, manufacturing and technology sectors have suffered severe disruption due to extreme weather in the past three years.

“The frequency of extreme weather events has increased, and for businesses facing these hazards, the dice are loaded,” says Dr. Angelika Werner, research area director, climate risk and resilience at FM. This growing frequency reflects increasing global temperatures, she adds. “Temperature is just one element in the whole weather system, but it influences the complete atmospheric and oceanic system. Higher temperatures warm up the oceans, which results in more intense hurricanes, convective storms and heavy rain events. They also increase the likelihood of droughts and wildfires—it’s all connected.”

Extreme weather and the board

Fortunately, businesses are leaning into this challenge. The frequency of these events, the disruption they cause, and the economic losses that result mean that extreme weather is firmly on the board agenda. Four in 10 risk decision-makers (41%) say extreme weather risks are regularly discussed by their executive board, ahead of climate change, reputational risk, and even the prospect of another pandemic.

“Five years ago, some clients with forward-thinking boards would ask us what FM is doing to mitigate climate or natural hazard-related risks,” says Dr. Louis Gritzo, chief science officer at FM. “Now, pretty much every client has it on their radar to some extent.” In part, the attention that boards are paying to extreme weather reflects growing pressure from regulators and investors to address climate-related risks. “It started as a financial reporting issue—if I’m investing in a business, I want to know they understand their climate risk,” Dr. Gritzo explains. “But it has evolved into a regulatory requirement. In Europe, the regulations now expect businesses to show how multiple climate scenarios could affect them, and the same shift is happening in the US and Australia.”

Many businesses now address climate resilience—the ability to withstand the disruptive impact of a warming climate—as part of their sustainability agenda: 80% of respondents say climate adaptation and resilience are an explicit part of their ESG strategy.

But it also reflects growing concern among the workforce. More than three-quarters of risk decision-makers (80%) say their employees are increasingly concerned about their employer’s exposure to extreme weather events.

Not only are boards alert to extreme weather risks, but they are also aware of the far-reaching implications. According to our survey respondents, boards are equally focused on the risks that extreme weather poses to local infrastructure—such as power and transport networks— and to supply chains, as they are on property damage and interruptions to internal operations (see Fig. 1).

This appreciation of their wider exposure to extreme weather is essential. For one thing, the interconnectedness of global supply chains means that any business can be rocked by weather events on the other side of the planet.

China’s Pearl River Delta, for example, is a global hub for electronics and textiles manufacturing. It is also exposed to typhoons. “If that area of the world were hit with a significant event, it would impact the global supply chain for everybody,” says Stuart Keller, chief engineer at FM.

Extreme weather risk awareness

The C-Suite executives and risk managers surveyed for this report understand that historical weather patterns are not a reliable guide for current and future trends: 78% agree that changing weather systems mean that past assumptions about their exposure are no longer relevant.

Even so, they are broadly confident that they have a handle on their risk exposure: 95% believe they are either ‘fully’ or ‘mostly’ aware of the exposure of their business operations to extreme weather. Nine out of 10 say the same about their supply chains.

Brokers are less confident that businesses are aware of the risks: only 67% believe their clients are ‘mostly’ or ‘fully’ aware of how exposed their operations are to extreme weather.

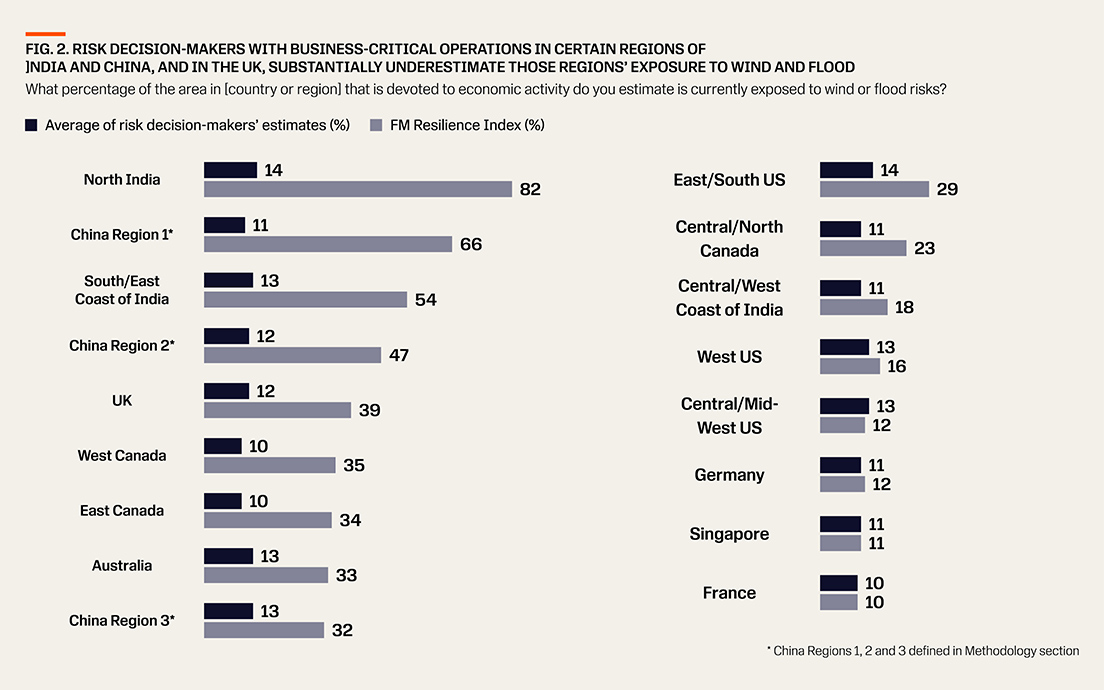

An informal test in our survey also suggests that businesses might be overconfident in their awareness. We asked risk decision-makers to estimate how much of the economic activity in the country or region in which their most critical business operations are based is exposed to wind or flood. We compared their estimates with FM’s Resilience Index, a ranking of 130 countries and territories’ resilience to risk, which includes a measure of their wind and flood exposure.

This revealed that 74% of risk decision-makers underestimate the exposure when compared to calculations in the FM Resilience Index. Estimates varied significantly by country and region: businesses with operations in North India, parts of China, and the UK, for example, substantially underestimate these areas’ wind and flood exposure (see Fig. 2).

Even so, awareness of extreme weather among businesses and their brokers is generally good, says Benedict McKenna, division claims manager for the UK and Asia Pacific at FM. “But the risk landscape is changing all the time, and tools like the FM Resilience Index help clients keep track of those changes,” he adds. “Awareness is all about education, and it is incumbent upon insurers like FM to use all our expertise and insight to provide that to corporates and their brokers.”

New approaches to risk assessment

This is why FM invests significantly into exploring the science of changing weather patterns, Dr. Angelika Werner adds. “Our scientists untangle what conditions drive extreme events. You can only develop an accurate risk model for wind and flood, for example, when you understand what is driving the extreme weather behind the hazard.”

Leading businesses are also adopting more sophisticated methods to understand their exposures, as Matt Barisic, a senior finance executive at a biotechnology company, explains. “We use a catastrophe modelling platform for multiple perils like flood, windstorm, earthquake, and hurricane. It includes probabilistic models, loss forecasting and there’s a financial analysis impact. It’s still a guesstimate, but it gives you a number [to work with].”

Tracking the weather alone won’t provide a complete picture of a business’s risk exposure, however. Firstly, the impact of extreme weather on a given site is specific to its individual characteristics. “You may have two facilities located two miles away and exposures may be very different,” explains Keller. “That’s why site-level assessment is really critical.”

Secondly, the evolution of business practices and building design is changing the nature and severity of risks.

“Energy efficiency is a primary concern for new buildings,” explains Jessica Waters, VP, manager, climate and structural resilience at FM. “But with that come fresh challenges, such as the use of unfamiliar building wall assemblies or insulation materials that we’ve never seen before. New building materials may behave differently when they’re exposed to extreme wind speeds.”

Businesses and their brokers are aware of their changing exposure to extreme weather events. But such is the pace of change—in both business operations and the climate— that organizations are finding their assumptions about weather risks to be outdated.